Movements | August 13th, 2018

Micromobility

Lime and Bird have made a point of proactively addressing equity concerns around their services. Most recently, Lime has expanded options for low-income bike and scooter riders including discounts and smartphone-free options. | The Verge

Scooters launched in Portland, OR about two weeks ago, and according to PBOT, they’ve already seen a ridiculous amount of usage:

47,836 trips

75,332 miles ridden

1.2 miles average trip

About 5–6 trips per scooter per day

The Port of Portland asked scooter operators to remove the Portland Airport from their service area after people started showing up on scooters. | Flypdx

Over 43,000 people in Atlanta used Bird to take 110,000 trips in 70 days with 400 scooters in Atlanta. | Atlanta Magazine

Kevin Wright takes the scooter parking problem into his own hands and starts spray painting “bird cages” on the ground in Cincinnati. Related: citizens are starting grassroots campaigns in D.C and San Francisco to increase dockless bike and scooter share caps | Cincinnati Business Courier

A new report from Populus.ai shares some interesting stats:

3.6% of people in markets with shared e-scooters have tried them — that’s surprisingly high for a product that’s been in market for less than a year.

Overall, 70% of people see shared e-scooters positively, though the number is closer to 52% in San Francisco

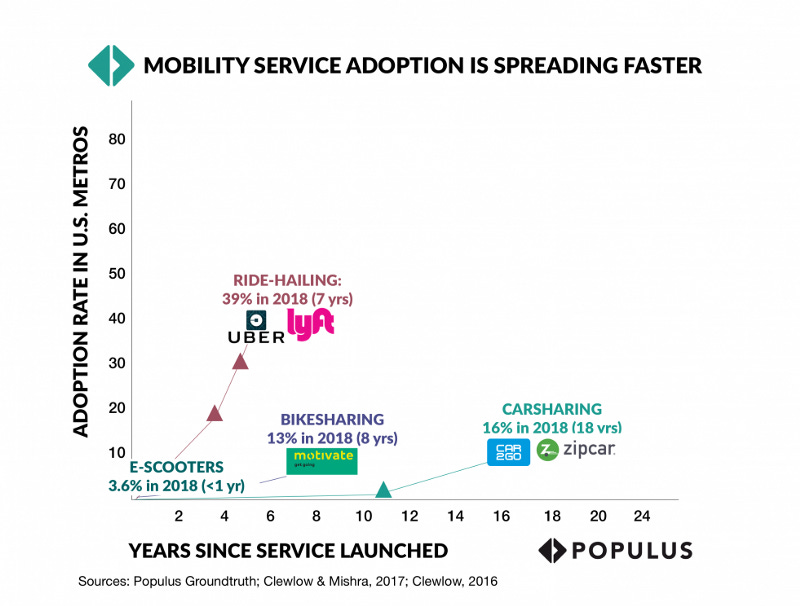

And finally, the rate of adoption for new mobility services is accelerating:

Mobility services adoption curves via Populus.ai

Santa Monica is set to recommend Uber and Lyft for bike and scooter share permits, over homegrown Lime and Bird | Santa Monica Next

Brazilian startup Yellow, launched dockless bikesharing in Sao Paulo. The founders, who previously started and sold 99 Taxis to Didi, hope to have 20,000 bikes by the end of the year. Electric scooters are coming as well | Reuters

TNCs

New York City has decided to cap the number of FHVs for the next 12 months and implement a driver pay floor to encourage better utilization of TNC fleets. It will be interesting to see how consumers, Lyft, Uber, and Via react to this in the US’s largest ridehailing market. | NYTimes

A new report methodically categorizes and analyzes all of the flavors of partnerships between TNCs and transit agencies | DePaul University

Didi is rebranding its driver services business, committing to invest $1B into the effort, and giving it more autonomy. The new group, now called Xiaoju Automobile Solutions, handles leasing, financing, repairs, refueling, car-sharing, and insurance for Didi drivers. Through its own operations and a network of partners, the new division is apparently on an annualized GMV run rate of $8.76B. | Techcrunch

Here’s a really good interview with Noam Bardin, CEO of Waze. They cover all kinds of topics ranging from adoption timelines for AVs, the role of maps, and how we’ll all end up with much worse traffic if we don’t learn to share our rides and governments don’t take action to shape travel behavior. | Growth Stage

Ridehailing firm Ola continues expansion outside of India with plans to launch in the UK.| The Guardian

Product Updates

Token Transit, a mobile ticketing platform for public transit agencies, launched a new data tool enabling its agencies to get richer insights into their riders travel patterns. Token serves over 45 public transit agencies across the US and Canada. | Token Transit

Investments and M&A

Cubic invests in and partners with Delerrock, a SaaS product for fare collection and digital ticketing. They’re most popular among small and medium sized transit operators who are typically too small to adopt Cubic’s existing solutions. | Cubic

Good Reads

An excellent piece on a critical technology that underlies the revolution in mobility services companies yes is owned by none of them: GPS | Bloomberg

Coord is building the developer platform for the mobility marketplace. Curious about what that really means? Check out this interview with the CEO. | GeoAwesomeness

Most people intuitively understand that an apartment or commercial space that is conveniently located to mass transit typically commands a premium, but here’s a study that explores just how that effect changes when considering the more flexible, on-demand services like ridehailing, car-share, and bike-share. This is a fairly data-rich look at the topic and some of the results are pretty exciting: “Depending on the market, different components of mobility influence rents in different ways. For example, in two Pacific Northwest markets, the most statistically significant component to explain rent per square foot in Portland is bikeshare, while in the Seattle market ridehailing has the most robust relationship with rents.” | RLCO

In the same vein, this analysis of the impact of the Roman road network on modern day Europe’s economic activity is fascinating: “Their data shows that infrastructure investments are — if you’ll pardon an unpardonable pun — a pathway to long-term prosperity.” Mobility is a necessary precondition to economic vitality, and it should be treated as such. Today, public and private actors can much more easily spend to improve mobility in a more flexible, on-demand manner without forking over tremendous sums over decades to build roadways. | Washington Post

MaaS: cracks in the vision? Mobility-as-a-Service is often regarded as the ‘holy grail’ of transportation. Richard Rowson lays out the challenges in the ‘MaaS’ vision and how to best address them. | Richard Rowson