Baby you can share my car...

Why buy a car, when you can Uber everywhere? UPDATED

Hey Movements Readers,

If you're into the car industry, Car Charts is a must-read. It's one of the top mobility newsletters, packed with charts and graphics that break down the latest in the car business. What really sets it apart is Glenn Mercer’s insightful commentary, backed by years of research in the automotive industry.

If you're looking for data-driven insights on the car industry, without the fluff, be sure to subscribe to Car Charts here.

This isn’t just another car blog — it’s a car industry blog.

I’ll let Glenn from Car Charts, take it from here...

One thing I love about the auto industry is how it thrives despite being in a seemingly permanent state of panic about the future. Just looking at past Armageddons that we somehow survived, I can list:

“We’ll go bankrupt from the spending needed to meet Clean Air Act standards!”

“The Japanese OEMs will sweep the board in America!”

“No, sorry, it’s the Korean OEMs who will wipe us out!”

“Let me try again, Chinese car companies will rule our market!”

“Huizenga’s AutoNation and other public chains will destroy private dealers!”

“Autobytel and other internet firms will disintermediate dealers!1”

“If we all live in cities we’ll never drive again!” (see the last post)

&tc. Add your own existential threat to the list.

Another panic attack of recent years was about the impending Mobility Services Massacre. (We’ll focus on the ridehail portion of MS here: no scooters.)

Ridehail2 companies like Uber and Lyft came to market based on one number: 95%. Cars on average are parked 95% of the time, meaning they are being driven only about 5% of the time. If a car costs, say, $10,000 a year all in (fuel, depreciation, insurance), and 5% of a year is roughly 500 hours, then we’re “paying” $20 an hour to go places. If we all gave up our cars and used ridehail instead, one ridehail car might be able to serve 10 people (meaning, simplistically, it could be utilized 50% of the time), cutting the cost per hour to maybe $3. Add in a buck for the ridehail company’s other costs and profit, and we have a clear winner. What idiot would own a car at $20 an hour when he could “rent” one for $4?

Well, I guess we’re all idiots, because as far as we can see, in the USA at least, ridehail has had virtually no impact on personal ownership of cars, and thus no impact on sales of personally-owned cars. There are lots of reasons for this (contact me for some of the academic papers on the topic), including:

“If I own the car it’s available all the time, when an Uber may not be.”

“I don’t want to ride around in a car filled with someone else’s germs!”

“There ain’t no Lyft service here in rural Iowa!”

“I want to leave my stuff in the trunk.”

“The unsubsidized rates have gone up and the service has gone down.”

“I have a kid, you think I want to drag around a car seat for Ubers?”

&tc.

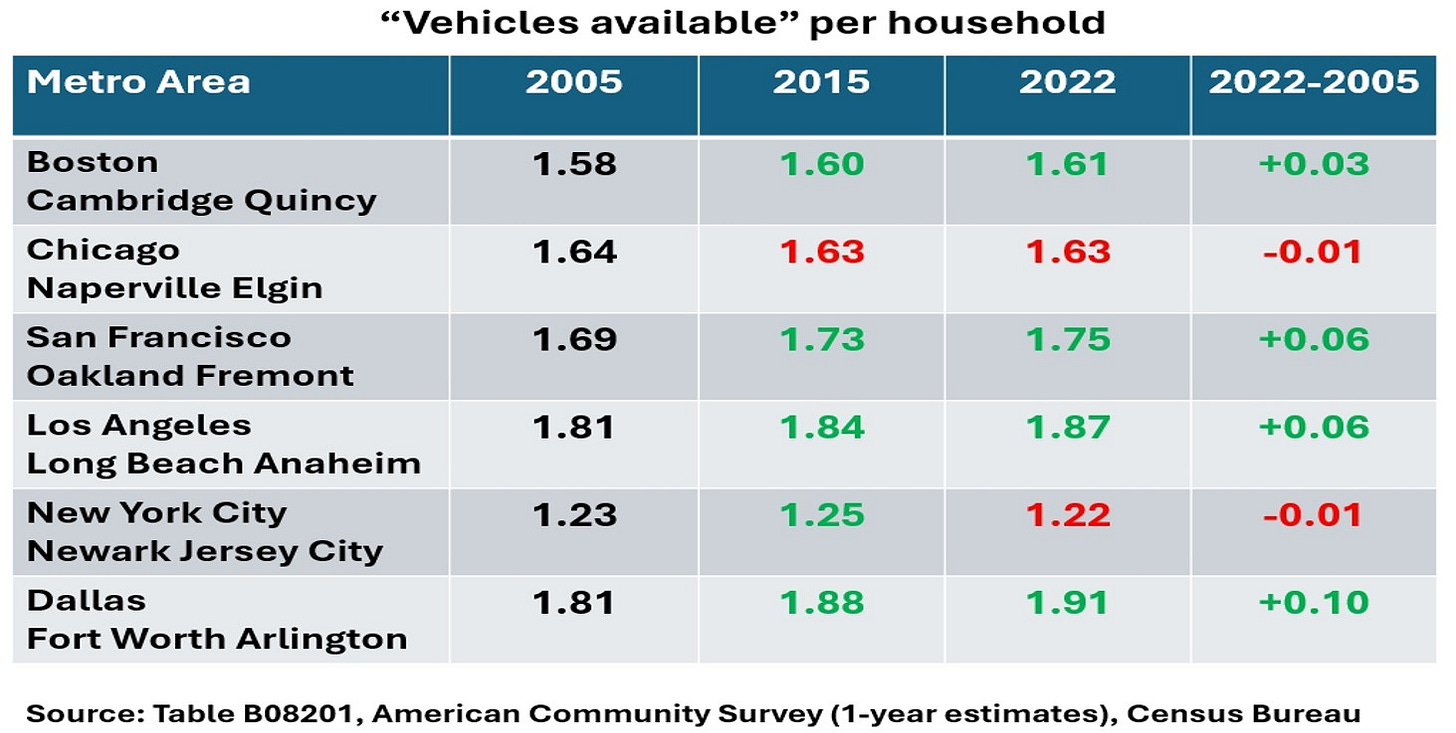

How do we know that these reasons, and any other factors, are indeed causing ridehail to have minimal impact on car sales? Well, we don’t know directly: no one asks a car owner who sells his car to sign an affidavit stating “I did this because I intend to use ridehail from now on.” But the brilliant traffic-and-transit researcher Bruce Schaller3 uses an indirect approach to the question. He looks at household ownership of cars (cars-per-household) over time, in major American cities. (He looks at cities because this is where ridehail should flourish, if anywhere.) If, after a decade of ridehail’s existence (Uber launched in 2009, Lyft in 2012), Americans were giving up owning cars in favor of “sharing” them, we should see the cars-per-household number fall over time. But we don’t. Mr. Schaller used US Census data to establish the cars-per-household number in major American cities in 20064 and 2018, and I’ve updated the data to include more recent years (as well as stretching back to 2005). Here’s the result:

I’ve highlighted in red where ownership has dropped, and in green where it has grown. Even San Francisco, which is Ground Zero for mobility service innovation, has added cars5. But overall, there’s been no significant change. To put it bluntly:

After a decade of ridehail, it has had no impact on car ownership in America.

Mr. Schaller, being a civilized and qualified academic researcher (I am neither!) put this more diplomatically: “The evidence in these data certainly fails to support the proposition that ride-hail has produced lower levels of vehicle ownership. Rather, these trends tend to suggest that the influx of ride-hail and other new mobility options has not translated to lower vehicle ownership rates.”

And this is after Uber and Lyft have together cumulatively lost some $40 billion, spending much of that on holding prices below cost, in order to attract more users. But even after loss-leader pricing, it still has not gained traction against ownership.

Will ridehail impact vehicle ownership in the future? Maybe! Has it lowered vehicle ownership already, below what it otherwise would have been? Would LA be at 2.0 cars per household by now, without Uber and Lyft? Maybe. But overall, I vote for equilibrium not extrapolation: ridehail has entered America’s “portfolio” of mobility options, and now will coexist with personal car ownership, just like all the other mobility services. Rental cars (which have been around a while: Hertz was founded in 1918) are a mobility service, and sure, without rental cars we’d all own more of our own cars. Airlines are mobility services: yes, we’d drive more if we couldn’t fly everywhere. Same for bus, train, tram, even feet6. Ridehail doesn’t kill personal car ownership: it lives alongside it. Using our cars only 5% of the time may be irrational, but we seem fully wedded to the concept.

===

Next time around: Does the Commute no Longer Compute?

Not to pick on Autobytel (now called AutoWeb), but this company went public in 1999 at about $200 per share, and is trading as of today at about 40 cents.

I refuse to call them rideshare, since after all you’re paying for a ride. I guess the idea is the driver will share her car with you if you will share your money with her?

http://www.schallerconsult.com/

Using 2006 let him establish a pre-Great Recession and pre-ridehail baseline.

See https://cangoroo.tech/ I kid you not.